Today, WT Trading from 830-1100 AM was very choppy. Ross ended up losing a couple thou and a few times I was tempted to get into a position that wasn't one of my GTSetups. Compared to last year, i'm much more aware of the thoughts/feelings/emotions going through my head and was able to just sit back and observe. The emotions were still there but I was for alot more composed and not enter the scalp trades. Early day momo ended with me just watching the market and slowly getting back into the groove of the small caps.

But I kept my monitors on and saw a couple of charts familiar to me. The slight problem at the time for me is that this past year, i've grown sensitized to scalping which has a very fast tempo of trading. The charts that I was looking at were familiar but of a vastly slower tempo. I haven't seen this style/trading tempo in real time for more than a year and wasn't confident in playing it out.

Yes, sticking to one or two plays and staying away from opposite styles of trading is a good way to start. But, I feel like I can handle both for now, I just need to visualize the setups more and refine the criteria for the GTSetups. If it doesn't work out for me later, I can always cut back but right now I need to be putting in skin in the game alot to get through the learning curve again.

But I kept my monitors on and saw a couple of charts familiar to me. The slight problem at the time for me is that this past year, i've grown sensitized to scalping which has a very fast tempo of trading. The charts that I was looking at were familiar but of a vastly slower tempo. I haven't seen this style/trading tempo in real time for more than a year and wasn't confident in playing it out.

Yes, sticking to one or two plays and staying away from opposite styles of trading is a good way to start. But, I feel like I can handle both for now, I just need to visualize the setups more and refine the criteria for the GTSetups. If it doesn't work out for me later, I can always cut back but right now I need to be putting in skin in the game alot to get through the learning curve again.

CHEK

Around 11am, as I was starting to call it a day, I noticed a CHEK doing something I've seen before and formed a plan in my head for it and just watched it. All my criteria was met but I settled on watching it for now. CHEK spiked for what was to become the day's/week's hottest stock. Next image is the aftermath of shorts getting squeezed. I've seen this a few times in the past before already, consolidated/held under VWAP and once it broke VWAP/prior resistance levels, it squeezed to HOD and broke past that and squeezed even more shorts.

It consolidated again and squeezed up even higher. Same play but since it was already extended past the 5min ema and VWAP, I didn't consider taking it.

Next image is how it ended the day.

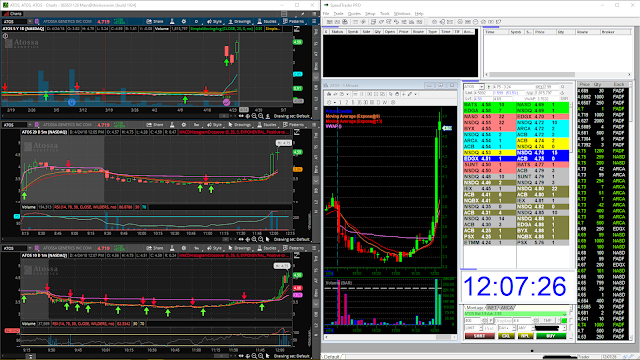

ATOS

After the first spike started becoming boring, traders jumped on ATOS. It's a reverse split, shitty company. It didn't have the typical spike and chart pattern since it was an RS, but it gapped above the previous day high trapping some shorts. It wasn't the same exact pattern but still similar, consolidated under VWAP but above the previous day's high. As soon as it broke through VWAP, it got squeezed into a halt. After the halt, it opened and squeezed past the high from 2day's back and squeezed more shorts. I would've pulled the trigger right when it was riding along the VWAP but I still paused. I realized after the trade that I still need to refine my entry on this a little bit more and another reason for the pause was that I JUST REMOVED midday perks from my GTSetups. Talk about rough lesson haha.

Unlike CHEK, ATOS just faded away in the PM til close.

Next image is CHEK and ATOS side by side to show the similarities/differences of the charts.

Today was a good day, I need to keep refining my routines and criteria for my GTSetups. Today was also the first day where I started to take note of the volumes into my plan. ATOS was an RS with no real resistances ahead so I treated it as a fresh chart. Without taking note of the volume, I wouldve previously charted some resistance lines. But with how I look at volume now, what I previously thought might be resistances aren't very good resistance areas at all. This puts me one step ahead of early/new shorts who don't see it the way I do.

Anyways, ending the day.. keep grindin' forward..

Ciao