8 May

FEYE

Can't remember what happened... Profit.ly is averaging all my entries and exits and I didn't write down anything after the trade except to screenshot the chart. Will start adding a quick synopsis after trading that day and then doing a weekly review on the weekends.

KTOS

Green trade but commissions made it red. 200 shares size is too small. 400 is the lowest I'd go so I'm not sure why I decided to go 200 that day. I need to make sure that I appropriately size my positions, not too big but not too small that the commissions eat me alive either.

10 May

NVDA

Am getting better at sizing in / out of bigger priced NASDAQS, the problem i'm having is that using the WT style, i'm confusing styles and end up scalping instead of basing it off the bigger move. This should've been a swing long.. Sell half on the AM spike and hold rest/dip buy off VWAP.

PRTO

5 cent tick.. Chased my entry, shouldn't have done it pre-market and waited til open to see more volume. Gap and go setup but wait for open on 5cent ticks to see better price action with the more volume.

MTBC

I entered on a 1min microPB. Sold half and rest blew through my stop at breakeven. My % on 1min PB and Micro PB have been really bad since i've been entering so far from the VWAP/MAverages. I'm most likely going to limit trading these only during hot markets/sector plays and focus more on the other setups.

11 May

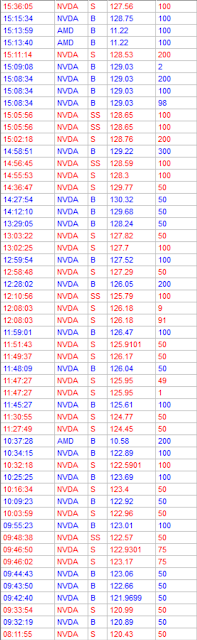

NVDA

My worst day ever and what I've been dreading from mixing WT style and My own style. This feels exactly how I first papertraded and kept on scalping. Buy high just to panic and sell low. FOMO > Short low then panic and sell high. I traded off emotions and nothing objective/supports and resistances.

I started the day off bad being -$100 realized then regain composure and getting up to $300 green realized. The problem was that I had to go double my size. I had called it quits right there and then but the stock kept on going higher and higher... but at the same time pulling away from VWAP. FOMO kicked in for some scalps and I kept scalping well until EOD.

Mixing the scalp with longer TF, I had an entry of a scalp but with the exit goal of a swing/overnight long. The BIG PROBLEM was that it was way off vwap and I'm in the trade well before power hour with very little volume to find out where the trend was. I ended up getting stopped out well past the ideal scalp stop loss.

I fat fingered a short while stopping out and ended up covering high like an idiot. I was trading off emotions and couldn't think clearly. Stock closed well towards vwap and would've made money off the fat fingered short but I was in too heavy and just wanted out.

Tried to dip buy a falling knife.. One mistake kept snowballing into another mistake = revenge trading. I included the share sizes in this trade just to show how bad doubling up / revenge trading went on the day. I ended the day -$300.

12 May

NVDA

Solid trades, kept composure and based trade off VWAP.

JWN

This I got off mike's alert, looked good to short but was too quick to jump in and not assess. RSI was oversold on both 1min/5min and was on it's 2nd down day already. I should've expected another reset before resuming further fade. Got stopped out.

SGMO

No comments:

Post a Comment