- Preparations / Travel / Move

GOALS FOR LAST WEEK:

- Account and get an assessment on how traveling will adversely affect habits and come up with systems for it.

Everything pretty much froze while I was going through the move. I'm now in houston, time to play catch up.

--------------------------------------------------------------------------------------------------------------------------

Schedule for the Current Week:

Tuesday GTOs

- Catch up on vids

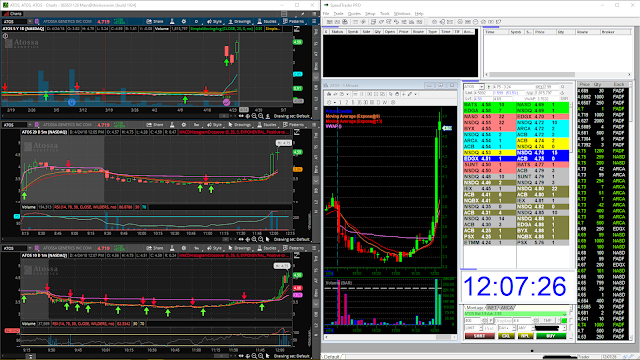

- Finish DUX vid / refine WoH

Rest of Week

- Get back into habits

- Assess how I quickly adjust back to routines while traveling

GOALS FOR THIS WEEK:

1) Getting into a routine while traveling is pretty much uncharted territory right now. I can already expect it to be tough but we'll see how well I adapt to doing what needs to get done while on the road and adjust from there. I might or might not consider logging daily for the meantime.

2) Increase attention and active listening during convos with other people. Increase frequency of attaining the observing self during the course of the day.

"Once I have a system, the only thing that matters is the six inches between my ears..."

--------------------------- For Whenever-------------------------------

**** Gamblers think about profits, Traders think about Risk ****

Shifting my attitude/mindset from making money and towards:

1) Risk Management

- Have plan before trade

- Know risk prior to trade

- Know stop loss prior to trade

- Size position accordingly to the stop loss

- ACCEPT RISK !!

2) Managing Emotions

- No more zombie trading

- No more revenge trading

3) Managing Mind

- Regular Meditations

- Objectivity Exercises

Mandatory Weekly Goals....

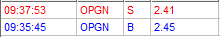

A) Zero (0) Zombie trades

B) Zero (0) Revenge trades

C) Trade only quality/Go-To-Setups.. (Think retired trader)

** Something I want to do in the future--Watch a stock's price action with NO indicators

Rule: If I have either 1 zombie trade or 1 revenge trade, I will sit out from trading for a mandatory 1 week cooling off. This will be a negative incentive that will turn me off from making those type of trades since almost all my motivation and raison d'être currently is daytrading.

*** ACCEPTANCE ***

*** ACCEPTANCE ***