1) Did NOT OVERTRADE

Cons:

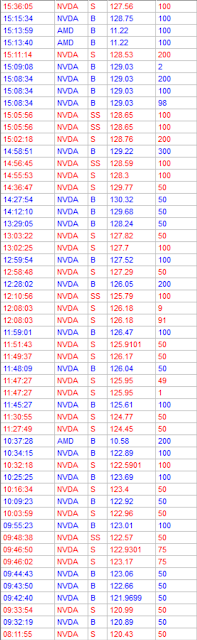

1) Applied WT Style scalp on Higher priced stocks = whipsawed back to VWAP.

---- Chased AMD on Tuesday, applied WT Style to IU Style stock

---- Chased NVDA on Thursday, applied WT Style to IU Style stock

---- Chased NVDA on Friday, applied WT Style to IU Style stock and now a bagholder !!!!

**** WT Style = Quick in and out, Make sure you're not extended on the 1min/5min/MA/VWAP

**** IU Style = Buy/Short based on VWAP

2) Let other's analysis affect my trade

****I can keep the chat open to use the scanner/alerts but NOT to use other people's analysis.

3) On Friday, I still oversized my position on the last FOMO NVDA trade.

**** Take the time to assess the trade prior to making the trade like I'm SUPPOSED TO !!!

4) On Friday, I snowballed emotional trades one after the other.

**** Take the time in between trades to assess my emotional state like I'm supposed to. It's much more controlled this week vs. last week but I'm still jumping from emotional trade to another. I thought up of a system/having an emotional thermometer beside my monitor--but I still haven't implemented it yet.

This week was much more solid trades and didn't overtrade. The biggest takeaway was realizing how to separate/distinguish which stocks I can use WT Style vs IU Style trading.

My main goal for every week for the next month NEEDS TO BE APPLYING the systems I've thought of this last month. I've been good at learning from my mistakes and coming up ways to prevent them. My problem is that i've been winging trading and haven't been applying the systems causing me to repeat the same mistakes from before.

MAIN GOALS every week til end of June:

1) Risk Assessment and Pre-gaming/Picturing the trade mentally PRIOR to the trade.

2) Emotional thermometer beside my monitor to remind me to assess how I am BEFORE/AFTER each trade.

3) If I'm in a trade that I am not COMFORTABLE with. GET OUT !!

4) Don't MIX WT Style vs IU Style and Day Trades vs Swing Trades