RECAP Schedule for Last Week:

Monday

- Full day schedule

- Finish Dux

*Didn't do*

Tuesday

- Full day schedule

- 1 Webinar / Trading ticks

*Didn't do*

Wednesday

- Full day schedule

- 1 Webinar / Trading ticks

*Didn't do*

Thursday

- Full day schedule

*1/3*

- 1 Webinar / Trading ticks

*Didn't do*

Friday

- Full day schedule

- 1 Webinar / Trading ticks

*Didn't do*

GOALS FOR THIS WEEK:

1) Refine Go To Setups / MUST HAVE THIS PRIOR TO TRADING *Was able to do 3 GTSetups

2) Refine WoH

*Did very little but need to turn these baby steps into bigger steps

3) Finish DUX DVD

*LULZ* This will be the goal this week

TRADING GOALS FOR THIS WEEK:

1) ONLY Take trades on GTSetups and AFTER Visualizing the Plan.

--------------------------------------------------------------------------------------------------------------------------

As far as habits:

I'm impressed with how fast I adapted my routine to the new environment. Biggest takeaway is being able to wake up early. If I don't follow my PM routine or stay up late, I'm basically setting myself up for failure the next day.

Ask Myself WHY I WOULD WANT TO SLEEP EARLY? I know I don't like going to bed early, but how can I de-energize staying up late and putting energy on the benefits of going to bed early??

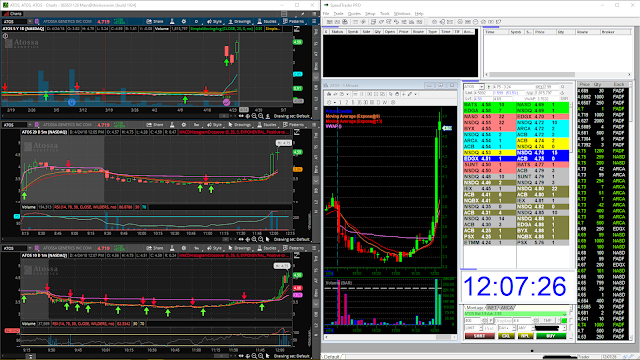

As far as trading mechanics:

Refined GTSetups:

1) Late day F3 o/n or ABCD PreMKT

2) Gap and Crap, r/g

3) Momo 5min PB

I still have yet to finish Dux DVD, Trading Tickers, and Webinars... I HAVE to get some hours in this week and at least finish DUX.

Schedule for the Current Week:

Mon - Fri

- Screen Time / Scans and making watchlists

-

GOALS FOR THIS WEEK:

1) Refine WoH / Visualize and plot fears

2) Finish DUX DVD

TRADING GOALS FOR THIS WEEK:

1) ONLY Take GTSetup trades AFTER visualizing it

2) Prioritize capital preservation over mindless trades

PREMEDITATIO MALORUM

FEAR SETTING / FEAR REHEARSAL for the week:

DEFINE ----------------------------- PREVENT ----------------------------- Repair

1) I get nothing done ------------------------Uhh, show up ----------------------------- Bounce back

2) I don't wake up early enough ---------- Follow PM Routine ---------------------- Bounce back

3) FOMO / Zombie trades ---------- GTSetups / Small pos size ---------------------- Learning Lessons

WHAT ARE THE BENEFITS OF PARTIAL SUCCESS:

1) If I get business done--I will move Kyzen Trading one step further into profitability.

2) If I wake up early enough--I will be awake for screen time and accomplish more tasks.

3) If I reduce FOMO / Zombie trades--I will preserve my capital and improve my discipline.

THE COST OF INACTION:

1 MONTH----------------------------- 6 MONTHS ----------------------------- 3 YEARS

1) Stuck where I'm at ----------------- Boredom, nothing to do ---------- I'd need a job to live in the US

2) I'm cheating myself out of screen time -- Slow trading improvement --- Bad habits control me

3) Reduced capital / equity ---------- LOSE ALOT OF CAPITAL ----- I'd need a job to live in the US

--------------------------- For Whenever-------------------------------

**** Gamblers think about profits, Traders think about Risk ****

Shifting my attitude/mindset from making money and towards:

1) Risk Management

- Have plan before trade

- Know risk prior to trade

- Know stop loss prior to trade

- Size position accordingly to the stop loss

- ACCEPT RISK !!

2) Managing Emotions

- No more zombie trading

- No more revenge trading

3) Managing Mind

- Regular Meditations

- Objectivity Exercises

Mandatory Weekly Goals....

A) Zero (0) Zombie trades

B) Zero (0) Revenge trades

C) Trade only quality/Go-To-Setups.. (Think retired trader)

** Something I want to do in the future--Watch a stock's price action with NO indicators

Rule: If I have either 1 zombie trade or 1 revenge trade, I will sit out from trading for a mandatory 1 week cooling off. This will be a negative incentive that will turn me off from making those type of trades since almost all my motivation and raison d'être currently is daytrading.

*** ACCEPTANCE ***